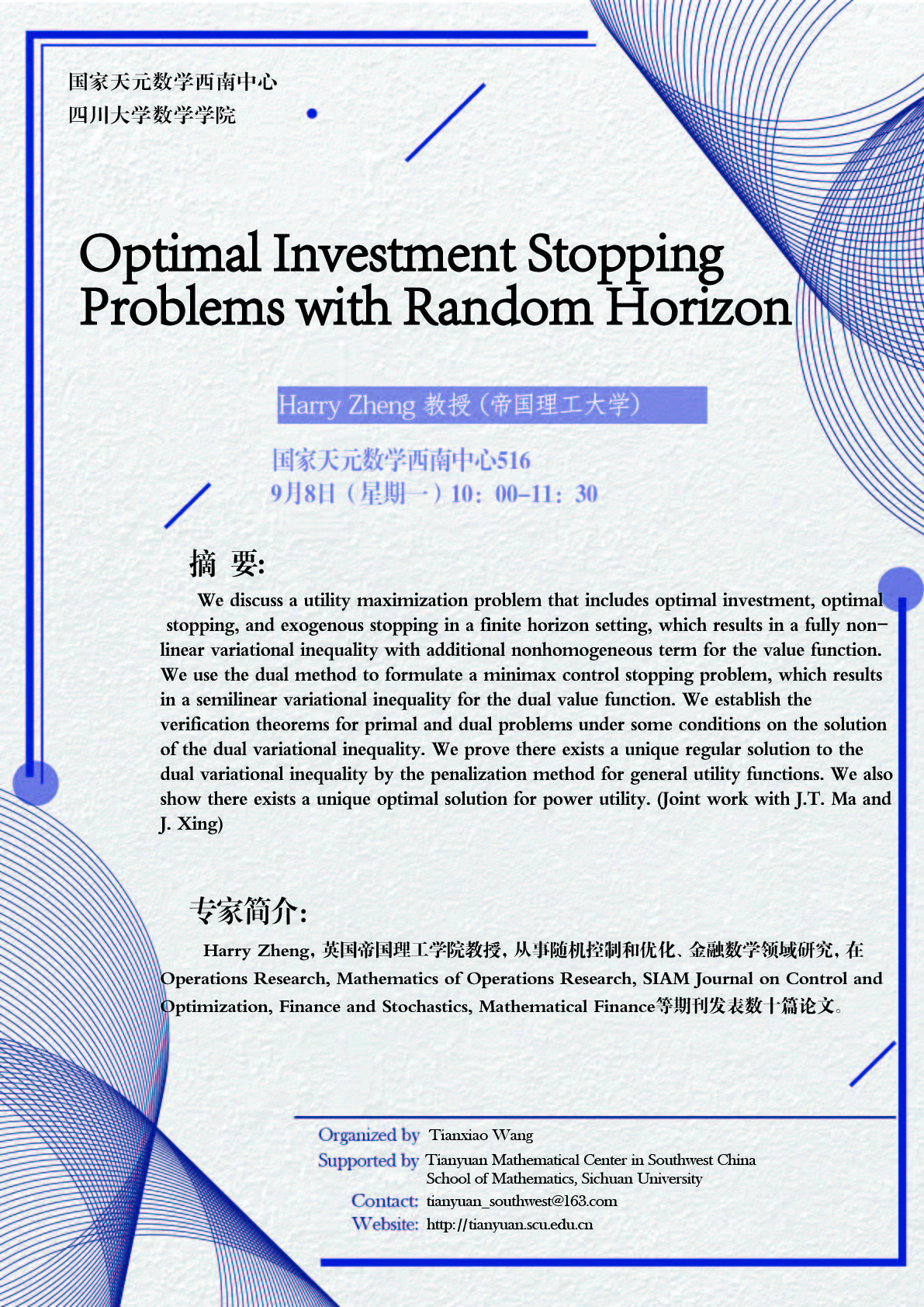

Optimal Investment Stopping

Problems with Random Horizon

报告专家:Harry Zheng 教授 (帝国理工大学)

报告时间:9月8日(星期一)上午10:00-11:30

报告地点:国家天元数学西南中心516

报告摘要:

We discuss a utility maximization problem that includes optimal investment, optimal stopping, and exogenous stopping in a finite horizon setting, which results in a fully nonlinear variational inequality with additional nonhomogeneous term for the value function. We use the dual method to formulate a minimax control stopping problem, which results in a semilinear variational inequality for the dual value function. We establish the verification theorems for primal and dual problems under some conditions on the solution of the dual variational inequality. We prove there exists a unique regular solution to the dual variational inequality by the penalization method for general utility functions. We also show there exists a unique optimal solution for power utility. (Joint work with J.T. Ma and J. Xing)

专家简介:

Harry Zheng,英国帝国理工学院教授,从事随机控制和优化、金融数学领域研究,在Operations Research, Mathematics of Operations Research, SIAM Journal on Control and Optimization, Finance and Stochastics, Mathematical Finance等期刊发表数十篇论文。

邀请人:王天啸